The Market Trends and Indicators Digest presents a critical analysis of key economic metrics, including GDP growth rates and unemployment figures. These data points, such as 768610000 and 3496565769, reveal underlying patterns that influence investment strategies. Understanding these trends is essential for navigating market volatility. However, the implications of these indicators extend beyond mere numbers, hinting at both emerging opportunities and potential risks that warrant further exploration.

Analysis of Market Trends

As market dynamics continually evolve, analyzing market trends becomes essential for understanding economic shifts and consumer behavior.

By examining market volatility, investors can refine their investment strategies, aligning them with emerging patterns.

Economic forecasts, informed by these trends, provide valuable insights, enabling stakeholders to anticipate changes.

This analytical approach empowers individuals to navigate the complexities of the market landscape with greater confidence and autonomy.

Key Indicators Overview

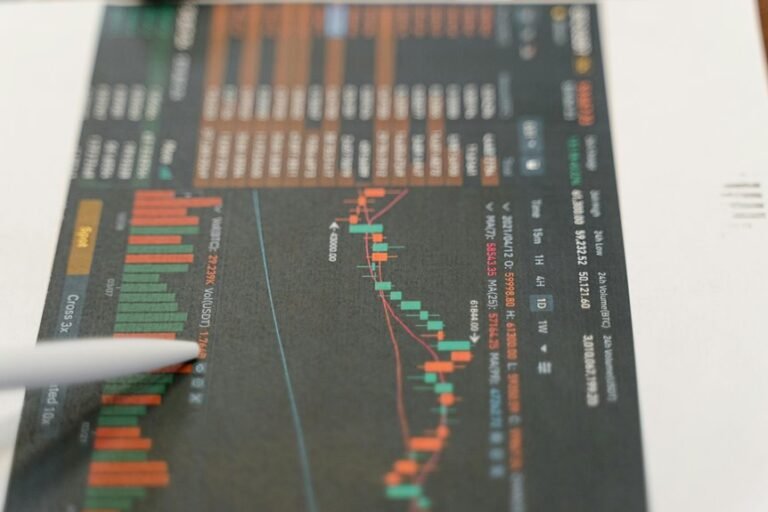

Understanding market trends requires a keen awareness of key indicators that signal economic health and potential shifts.

Key performance metrics, such as GDP growth rates and unemployment figures, serve as essential economic benchmarks. These indicators provide a framework for assessing market dynamics, enabling informed decision-making.

Insights From Data Points

Analyzing data points reveals critical insights that shape market forecasts and investment strategies.

The identification of data correlation among various indicators enhances trend forecasting accuracy, enabling investors to navigate market dynamics effectively.

Emerging Opportunities and Risks

Market dynamics continually evolve, presenting both emerging opportunities and inherent risks that investors must navigate.

Sustainable investments are gaining traction, driven by technological advancements, yet they face challenges from market volatility and regulatory changes.

Increasing awareness of environmental, social, and governance factors offers potential growth avenues, but the shifting regulatory landscape necessitates a vigilant approach to mitigate risks while capitalizing on these opportunities.

Conclusion

In conclusion, the examination of key market trends and indicators reveals a complex landscape where opportunities and risks coexist. Investors must remain vigilant, as navigating this terrain requires a keen understanding of economic signals. With the right data at their fingertips, they can spot the silver lining amidst the clouds of market volatility. Ultimately, informed decision-making will be crucial in capitalizing on emerging prospects while mitigating potential pitfalls in an ever-evolving economic environment.